In our previous blog post we had discussed about How to Find Total User Licenses in Salesforce. In these blog post we discuss about What is Fiscal Year in Salesforce

Contents

- 1 What is Fiscal Year in Salesforce

- 1.1 Introduction fiscal year in salesforce:-

- 1.2 Understanding Fiscal Year in Salesforce:-

- 1.3 Types of Fiscal Years in Salesforce:-

- 1.4 Configuring Fiscal Year in Salesforce:-

- 1.5 Implications of Changing the Fiscal Year

- 1.6 Best Practices for Managing Fiscal Year:-

- 1.7 Common Issues and Troubleshooting:-

- 1.8 Conclusion:-

- 1.9 FAQs:

- 1.9.0.1 Can I switch from a Standard Fiscal Year to a Custom Fiscal Year?

- 1.9.0.2 What happens to my reports if I change the Fiscal Year?

- 1.9.0.3 Can I have different Fiscal Years for different departments in Salesforce?

- 1.9.0.4 How often should I review my Fiscal Year settings?

- 1.9.0.5 Who can change the Fiscal Year settings in Salesforce?

What is Fiscal Year in Salesforce

Introduction fiscal year in salesforce:-

Salesforce is a robust CRM platform designed to help businesses manage their customer relationships, sales processes, and overall operations efficiently. One crucial aspect of Salesforce that impacts reporting and financial management is the “Fiscal Year.” Understanding what a Fiscal Year is in Salesforce and how to configure it correctly can significantly enhance your business’s financial tracking and reporting capabilities.

Understanding Fiscal Year in Salesforce:-

Definition and Purpose:-

The Fiscal Year in Salesforce refers to the 12-month period used by an organization for accounting and financial reporting purposes. It is essential for aligning Salesforce reports and forecasts with the company’s financial calendar. Unlike the calendar year, which runs from January to December, a fiscal year can start in any month and run for 12 consecutive months.

Types of Fiscal Years in Salesforce:-

Salesforce supports two types of fiscal years: Standard Fiscal Year and Custom Fiscal Year.

1. Standard Fiscal Year:-

A Standard Fiscal Year follows the Gregorian calendar, starting on January 1st and ending on December 31st. It is suitable for organizations whose financial year aligns with the calendar year.

Advantages:

-

Simplicity: Easier to manage as it aligns with the regular calendar.

-

Standard Reporting: Compatible with default Salesforce reporting tools without additional configuration.

2. Custom Fiscal Year:-

A Custom Fiscal Year allows organizations to define a fiscal year that does not align with the calendar year. For instance, a fiscal year might start on April 1st and end on March 31st of the following year.

Advantages:

-

Flexibility: Accommodates businesses with unique financial periods.

-

Alignment: Ensures financial reporting aligns with the company’s internal accounting practices.

Configuring Fiscal Year in Salesforce:-

Step-by-Step Guide to Setting Up a Fiscal Year:-

To create a custom fiscal year in Salesforce, follow these steps:

-

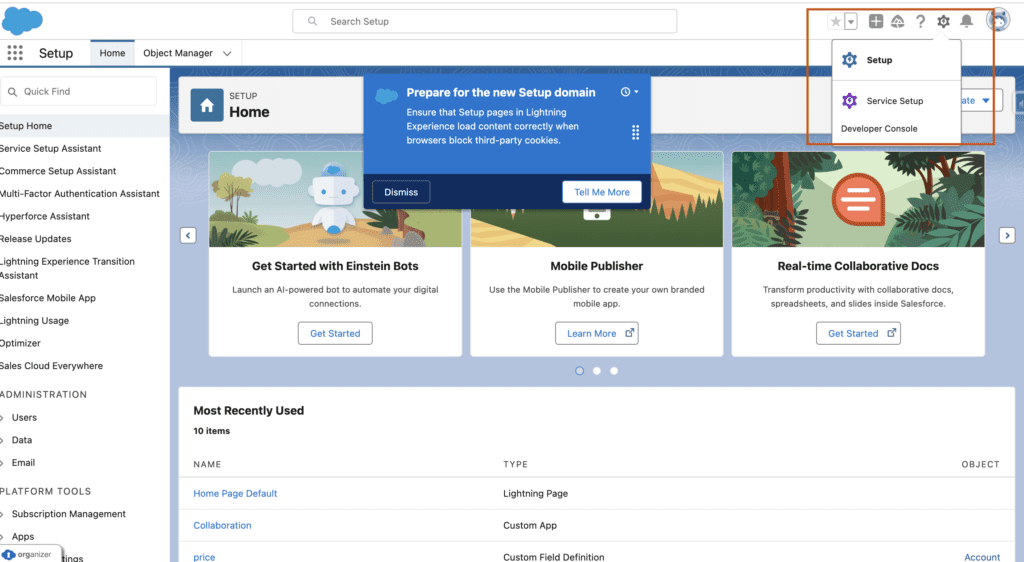

Access Setup:

Log in to Salesforce and click on the gear icon to access Setup.

-

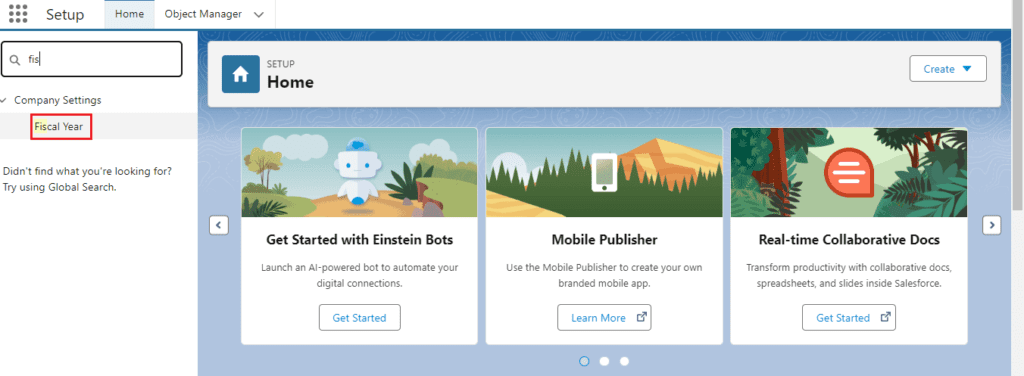

In Setup, type “fiscal year” in the search bar and select “Fiscal Year” under Company Settings.

-

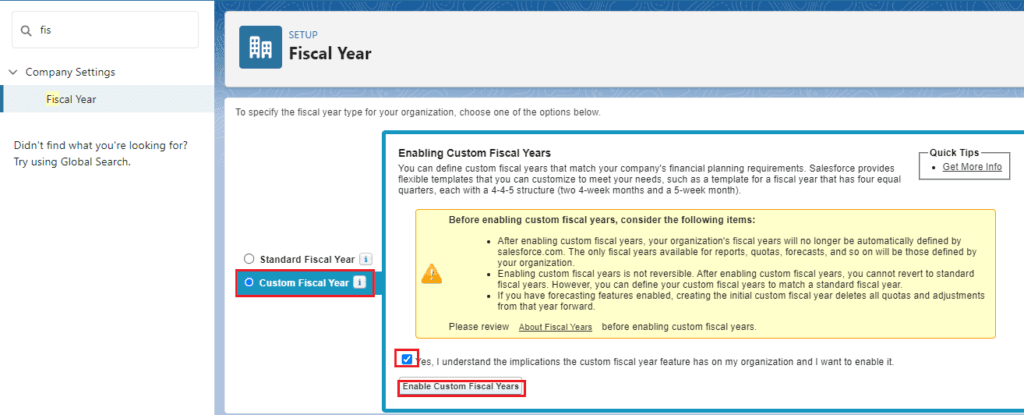

Enable Custom Fiscal Year:

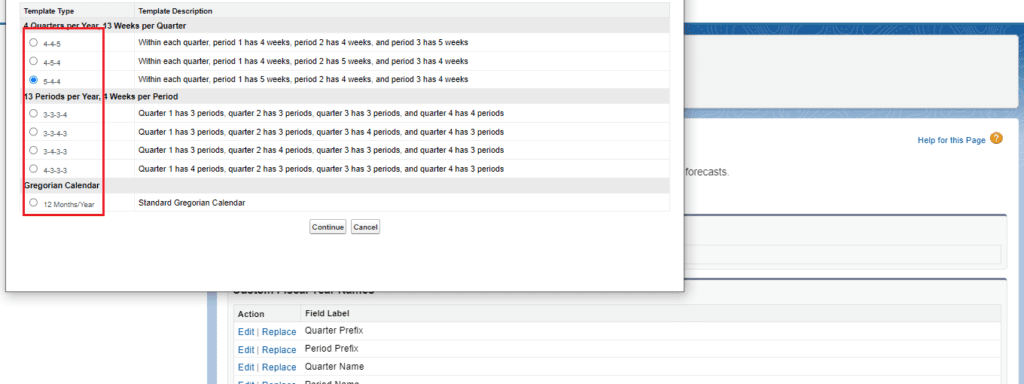

Choose the option to enable a custom fiscal year, which allows you to define fiscal periods based on your business needs.

-

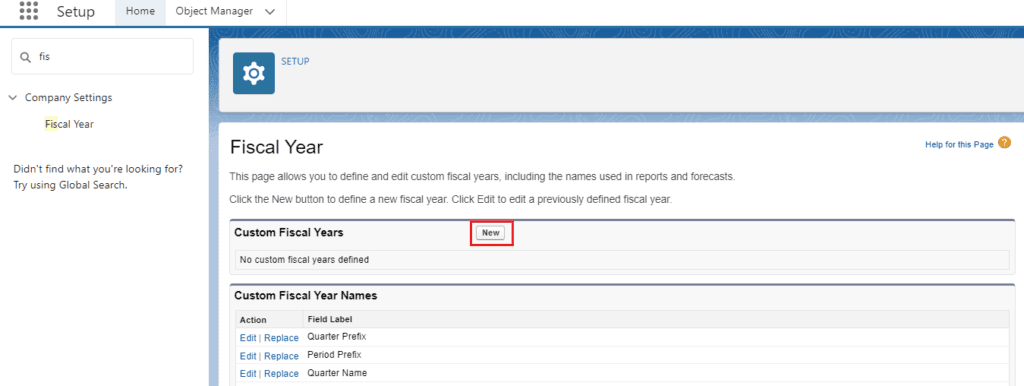

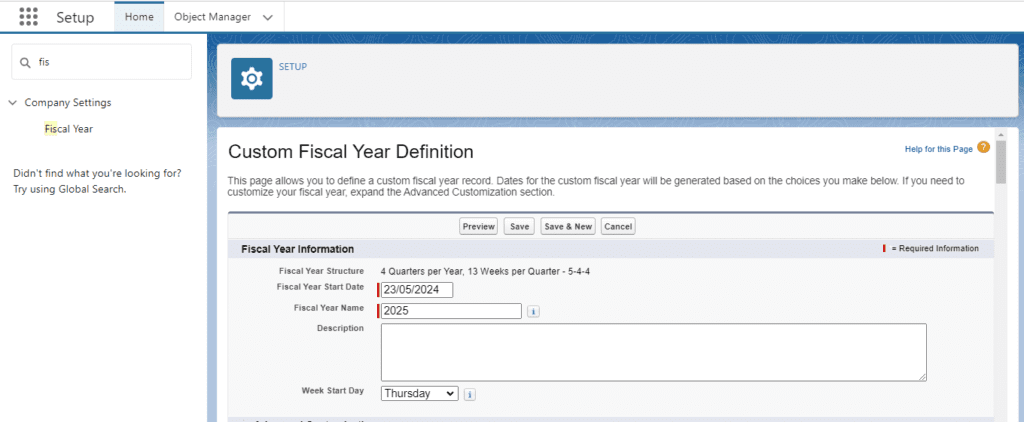

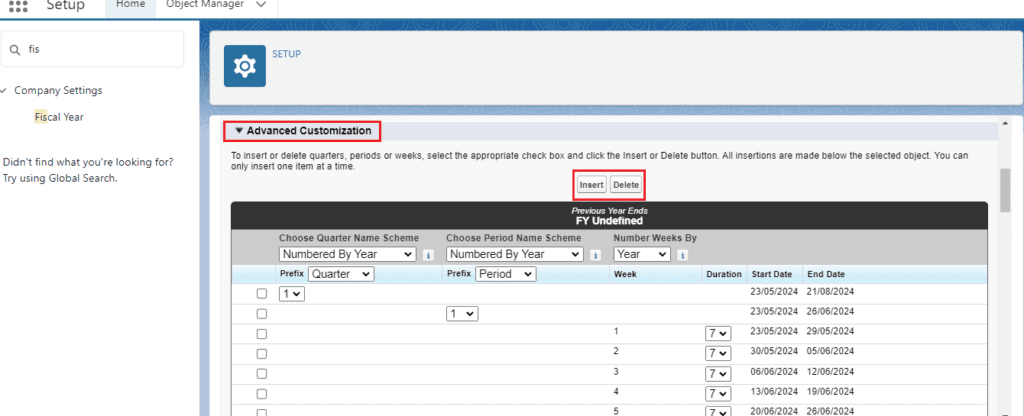

Configure Fiscal Year Structure:

Define the number of weeks per period and periods per quarter to set up your custom fiscal year structure.

-

Set Start Date and Name:

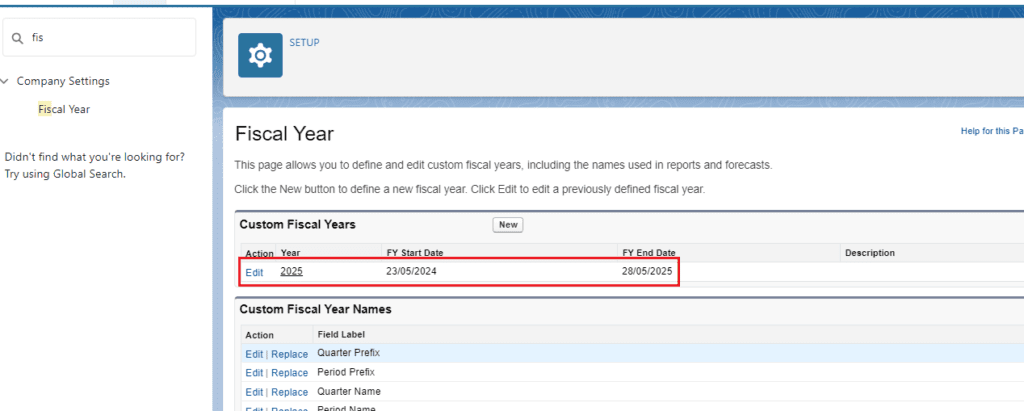

Choose the start date for the fiscal year and provide a name for the fiscal year, ensuring it aligns with your organization’s financial structure.

-

Save Configuration:

Review the settings, make any necessary adjustments, and save your custom fiscal year configuration.

By following these steps, you can create a custom fiscal year in Salesforce tailored to your organization’s financial planning and reporting requirements

You want to know more about this topic What is Fiscal Year in Salesforce click here

Implications of Changing the Fiscal Year

Changing the fiscal year setting in Salesforce can have significant implications:

-

Reporting: Historical reports and forecasts may need adjustment to align with the new fiscal year.

-

Data Integrity: Ensure that all financial data is reviewed and adjusted accordingly to maintain data integrity.

Best Practices for Managing Fiscal Year:-

Regular Reviews:-

Regularly review your fiscal year settings to ensure they align with any changes in your business’s financial reporting requirements.

Communication:-

Communicate any changes in the fiscal year to all relevant stakeholders, including the finance team and Salesforce administrators, to ensure smooth transitions.

Training:-

Provide training for your team on how to use and report based on the fiscal year in Salesforce. This ensures everyone is aware of how the fiscal year impacts reporting and data entry.

Common Issues and Troubleshooting:-

Incorrect Fiscal Year Settings:-

If the fiscal year settings are incorrect, it can lead to misaligned reports and forecasts. Regularly review these settings and update them as necessary.

Data Misalignment:-

Changing the fiscal year can cause data misalignment. Ensure that all data is reviewed and adjusted to reflect the new fiscal year accurately.

Conclusion:-

Understanding and correctly configuring the Fiscal Year in Salesforce is crucial for accurate financial reporting and forecasting. Whether you choose a Standard Fiscal Year or a Custom Fiscal Year, ensuring that your Salesforce settings align with your business’s financial calendar can lead to more precise reporting and better financial management.

FAQs:

-

Can I switch from a Standard Fiscal Year to a Custom Fiscal Year?

- Yes, you can switch from a Standard to a Custom Fiscal Year, but it requires careful planning and review of your financial data.

-

What happens to my reports if I change the Fiscal Year?

- Reports may need to be adjusted to align with the new fiscal year. Historical data will also need to be reviewed to ensure accuracy.

-

Can I have different Fiscal Years for different departments in Salesforce?

- No, the Fiscal Year setting in Salesforce is global and applies to the entire organization.

-

How often should I review my Fiscal Year settings?

- It’s good practice to review your Fiscal Year settings annually or whenever there is a significant change in your business’s financial reporting structure.

-

Who can change the Fiscal Year settings in Salesforce?

- Typically, only users with administrative privileges can change the Fiscal Year settings in Salesforce.

In our next blog post we will discuss about How to Setup Holidays in Salesforce

3 thoughts on “What is Fiscal Year in Salesforce”